UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | | | | | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

| OCEANEERING INTERNATIONAL, INC. |

| (Name of Registrant as Specified in its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| þ | | No fee required. |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies:

|

| | 2) | | Aggregate number of securities to which transaction applies:

|

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | 4) | | Proposed maximum aggregate value of transaction:

|

| | 5) | | Total fee paid: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount previously paid:

|

| | 2) | | Form, Schedule or Registration Statement No.:

|

| | 3) | | Filing party:

|

| | 4) | | Date filed:

|

OCEANEERING INTERNATIONAL, INC.

11911 FM 529,5875 N. Sam Houston Pkwy. W., Suite 400, Houston, Texas 77041-300077086

March 26, 202129, 2024

Dear Fellow Shareholder:

You are cordially invited to attend the 20212024 Annual Meeting of Shareholders of Oceaneering International, Inc. The meeting will be held on Friday, May 7, 2021,10, 2024, at 8:30 a.m., Central Daylight Saving Time. Due to concerns regarding the health and safety of our shareholders, directors, officers, employees and other meeting participants arising from the coronavirus (COVID-19) pandemic, the Annual Meeting will be held solely by remote communication via a live audio webcast. Shareholders will not be able to attend the meeting in person.

The format of the virtual meeting has been designed to ensure that shareholders who attend the meeting will be afforded the same rights and opportunities to participate as they would Time,at an in-person meeting. All of Oceaneering’s directors are currently expected to attend the meeting via the webcast. Oceaneering currently expects future annual meetings of its shareholders to be held in person. It is important that you retain a copy of the unique control number found on the proxy card, voting instruction form or notice, as that number will be required in order for shareholders to gain access as shareholders to the meeting via the webcast. As always, we encourage you to vote your shares by proxy prior to the annual meeting.5875 N. Sam Houston Pkwy. W., Houston, Texas 77086.

On the following pages, you will find the Notice of Annual Meeting of Shareholders and Proxy Statement giving information concerning the matters to be acted on at the meeting. Our Annual Report to Shareholders describing Oceaneering’s operations during the year ended December 31, 20202023, is enclosed.

We hope you will be able to attend the meeting. Whether or not you plan to attend, please take the time to vote. In addition to using the enclosed paper proxy card to vote, which you may sign, date and return in the enclosed postage-paid envelope, you may vote your shares via the Internet or by telephone by following the instructions included in this package.

Thank you for your continued interest and investment in Oceaneering.

| | | | | | | | |

| | |

John R. Huff

ChairmanM. Kevin McEvoy

Chair of the Board | | Roderick A. Larson

President and Chief Executive Officer |

Enclosures

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to Be Held on May 7, 202110, 2024

The accompanying Proxy Statement and Annual Report are available under the Filings & Reports tab in the Investor RelationsInvestors section of our website (www.oceaneering.com).

The following information applicable to the Annual Meeting may be found in the Proxy Statement and/or the accompanying proxy card:

•the date, time and location of the meeting;

•a list of the matters intended to be acted on and our recommendations regarding those matters;

•any control/identification numbers that you need to access your proxy card; and

•information about attending the meeting and voting your shares.

OCEANEERING INTERNATIONAL, INC.

11911 FM 529,5875 N. Sam Houston Pkwy. W., Suite 400, Houston, Texas 77041-300077086

| | |

NOTICE OF 20212024 ANNUAL MEETING OF SHAREHOLDERS |

To the Shareholders of Oceaneering International, Inc.:

The Annual Meeting of Shareholders of Oceaneering International, Inc., a Delaware corporation (“Oceaneering”), will be held at 5875 N. Sam Houston Pkwy. W., Houston, Texas 77086, on Friday, May 7, 2021,10, 2024, at 8:30 a.m., Central Daylight Saving Time. Due to concerns regarding the health and safety of our shareholders, directors, officers, employees and other meeting participants arising from the coronavirus (COVID-19) pandemic, the Annual Meeting will be held solely by remote communication via a live audio webcast. Shareholders will not be able to attend the meeting in person. The format of the virtual meeting has been designed to ensure that shareholders who attend the meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting.More details are provided below.

| | | | | |

Oceaneering Virtual Annual Shareholders Meeting |

Date: | Friday, May 7, 2021 |

Time: | 8:30 a.m., Central Daylight Saving Time |

Webcast Link: | www.virtualshareholdermeeting.com/OII2021 |

Time, (the “Annual Meeting”).The meeting will be held for the following purposes:

•elect fourthree Class II directors as members of the Board of Directors of Oceaneering to serve until the 20242027 Annual Meeting of Shareholders or until a successor has been duly elected and qualified (Proposal 1)(Proposal 1);

•cast an advisory vote on a resolution to approve the compensation of Oceaneering’s named executive officers (Proposal 2)(Proposal 2);

•ratify the appointment of Ernst & Young LLP as independent auditors of Oceaneering for the year ending December 31, 2021 (Proposal 3)2024 (Proposal 3); and

•transact such other business as may properly come before the Annual Meeting of Shareholders or any adjournment or postponement thereof.

The Board of Directors recommends votes in favor of Proposals 1, 2 and 3.

The close of business on March 17, 202120, 2024, is the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting or any adjournment thereof.

It is important that you retain a copy of the unique control number found on the proxy card, voting instruction form or notice, as that number will be required in order for shareholders to gain access as shareholders to the meeting via the webcast. As always, we encourage you to vote your shares by proxy prior to the annual meeting.

Our Board welcomes your attendance at the meeting. Whether or not you expect to attend the meeting, please submit a proxy as soon as possible so that your shares can be voted at the meeting. You may submit your proxy by filling in, dating and signing the enclosed proxy card and returning it in the enclosed postage-paid envelope.envelope; or you may vote your shares via the Internet or by telephone. Please refer to page 1 of the Proxy Statement and the proxy card for instructions for proxy voting via the Internet or by telephone.

| | | | | |

| By Order of the Board of Directors, |

| |

March 26, 202129, 2024 | David K. Lawrence

Jennifer F. Simons

Senior Vice President, General CounselChief Legal Officer and Secretary |

| | |

YOUR VOTE IS IMPORTANT!

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SUBMIT YOUR PROXY PROMPTLY VIA THE INTERNET OR BY TELEPHONE OR IN THE ENCLOSED POSTAGE-PAID ENVELOPE IN ACCORDANCE WITH INSTRUCTIONS IN THIS PROXY STATEMENT AND ON YOUR PROXY CARD. |

TABLE OF CONTENTS

OCEANEERING INTERNATIONAL, INC.

PROXY STATEMENT

PROXIES AND VOTING AT THE MEETING

Only holders of record of shares of Oceaneering International, Inc. (“Oceaneering”) common stock, $0.25 par value per share (“Common Stock”) at the close of business on March 17, 202120, 2024, will be entitled to notice of, and to vote at, the meeting. As of that date, 99,570,243101,387,004 shares of our Common Stock were outstanding. Each of those outstanding shares is entitled to one vote at the meeting. For 10ten days prior to the meeting, a list of shareholders entitled to vote will be available for inspection by any shareholder for any purpose germane to the Annual Meeting at our principal executive offices located at 11911 FM 529,5875 N. Sam Houston Texas.Pkwy. W., Suite 400, Houston, Texas 77086. If you would like to view the shareholder list, please call our Senior Vice President, General CounselChief Legal Officer and Secretary, David K. Lawrence,Jennifer F. Simons, at (713) 329-4500, to schedule an appointment. The shareholder list will also be available virtually for review during the Annual Meeting.

We are initially sending this Proxy Statement and the accompanying proxy to our shareholders on or about March 26, 2021.29, 2024. The requirement for a quorum at the meeting is the presence in person or by proxy of holders of a majority of the outstanding shares of Common Stock. There is no provision for cumulative voting.

Solicitation of Proxies

The accompanying proxy is solicited on behalf of our Board of Directors (our “Board”) for use at our Annual Meeting of Shareholders to be held at the time and place set forth in the accompanying notice. We will pay all costs of soliciting proxies. We will solicit proxies primarily by mail. In addition to solicitation by mail, our officers, directors and employees may solicit proxies in person or by telephone, facsimile and electronic transmissions, for which such persons will receive no additional compensation. We have retained Georgeson Inc.Innisfree M&A Incorporated to solicit proxies at a fee estimated at $11,000,$25,000, plus out-of-pocket expenses. We will reimburse brokerage firms, banks and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding proxy material to beneficial owners of our Common Stock.

The persons named as proxies were designated by our Board and are officers of Oceaneering. All properly executed proxies will be voted (except to the extent that authority to vote has been withheld), and where a choice has been specified by the shareholder as provided in the proxy, the proxy will be voted in accordance with the specification so made. Proxies submitted without specified choices will be voted as follows:

•FOR Proposal 1 to elect the director nominees proposed by our Board;

•FOR Proposal 2 to cast an advisory vote on a resolution to approve the compensation of Oceaneering’s named executive officers; and

•FOR Proposal 3 to ratify the appointment of Ernst & Young LLP as independent auditors of Oceaneering for the year ending December 31, 2021.

2024.

Methods of Voting

Voting by Mail – You may sign, date and return your proxy card in the pre-addressed, postage-paid envelope provided. If you return your proxy card without indicating how you want to vote, the designated proxies will vote as recommended by our Board.set forth above.

Voting by Telephone – If you are a shareholder of record, you may vote by proxy by using the toll-free number listed on your proxy card.

Voting via the Internet – If you are a shareholder of record, you may vote by proxy by using the following Internet address: www.proxyvote.com. Whether or not you choose to vote in advance, you may cast or change your vote by logging into and voting

Voting at the virtualMeeting – Shareholders of record may also vote at the Annual Meeting by following the instructions available on the meeting website during the meeting. Meeting. However,even if you plan to participate inattend the Annual Meeting, via the

webcast, we recommend that you also vote by proxy as described in this Proxy Statement, so that your votes will be counted if you later decidedo not to participate in the meeting.

The telephone and Internet voting procedures are designed to verify your vote through the use of a unique voter control number that is provided on each proxy card. The procedures also allow you to vote your shares and to confirm that your instructions have been properly recorded. Please see your proxy card for specific instructions.

If you hold shares through a brokerage firm, bank or other custodian, you may vote via the Internet or by telephone only if the custodian offers that option.

Revocability of Proxies

If you are a shareholder of record, and you vote by proxy by mail, the Internet or telephone, you may later revoke your proxy instructions by:

•sending a written statement to that effect to our Corporate Secretary at 11911 FM 529,5875 N. Sam Houston Pkwy. W., Suite 400, Houston, Texas 77041-3000,77086, the mailing address for the executive offices of Oceaneering, provided that we receive the statement before the Annual Meeting;

•submitting a signed proxy card with a date later than the date of the revoked proxy but prior to the Annual Meeting, with a later date;Meeting;

•voting by proxy at a later time, but prior to the Annual Meeting, via the Internet or by telephone; or

•voting at the Annual Meeting.

If you have shares held through a brokerage firm, bank or other custodian, and you vote by proxy, you may later revoke your proxy instructions only by informing the custodian in accordance with any procedures it sets forth.

Attending the Virtual Annual Meeting

To attend the virtual Annual Meeting log in at www.virtualshareholdermeeting.com/OII2021. Shareholders of recordAdmission

Admission to the Annual Meeting is limited to our registered holders and beneficial owners as of the closerecord date and persons holding valid proxies from those shareholders. Admission to our annual meeting requires proof of business on March 17, 2021 will need to enter, when prompted, their unique control numbers, which appear on theiryour stock ownership as of the record date, or a valid proxy cards (printed in the box and markedsigned by the arrow). Those without a control numberregistered holder or beneficial owner, and valid, government-issued photo identification. Security measures may attendbe applied for entry into the virtual Annual Meeting by registering, when prompted, as guests, but they will not have the option to vote their shares or ask questions during the Annual Meeting. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:00 a.m., Central Daylight Saving Time,meeting. The use of cameras, recording devices, phones and you should allow ample time for the check-in procedures. We also encourage you to visit www.virtualshareholdermeeting.com/OII2021 in advance of the Annual Meeting to familiarize yourself with the online access process and update yourother electronic devices as appropriate. The virtual Annual Meeting platform is fully supported across browsers and devices that are equipped with the most updated version of applicable software and plugins. You should verify your Internet connection prior to the Annual Meeting. Additionally, you should allow sufficient time after logging in to ensure that you can hear streaming audio prior to the start of the Annual Meeting.

Technical Assistance during the Virtual Annual Meeting

If you encounter difficulty with the Annual Meeting virtual platform during the sign-in process or at any time during the Annual Meeting, you may utilize technical support provided by the Company through Broadridge Financial Solutions, Inc. Technical support information is provided on the sign-in page for all stockholders. If you have difficulties accessing the virtual Annual Meeting during check-in or during the Annual Meeting, please call the technical support number listed on the Annual Meeting sign-in page. We will have technicians ready to assist you with any technical difficulties you may have.

strictly prohibited.

Submitting Questions at the Virtual Annual Meeting

In connection with the Annual Meeting, Oceaneering will hold a live Q&A session, during which its management intends to answer any questions submitted by shareholders of record during the meeting, in accordance with the Rules of Conduct for the meeting, which are pertinent to the meeting matters, as time permits. Shareholders may submit questions in writing during the meeting at www.virtualshareholdermeeting.com/OII2021. Shareholders will need their unique control numbers, which appear on their proxy cards (printed in the box and marked by the arrow). If there are questions pertinent to meeting matters that cannot be answered due to time constraints, our management will post answers to a representative set of such questions that are not addressed during the meeting as promptly as practicable following the meeting on our website at www.oceaneering.com under the links “Investor Relations”-“Governance.” Those questions and answers will be available as soon as practicable after the Annual Meeting and will remain available until we file our proxy statement for our 2022 Annual Meeting of Shareholders.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Restated Certificate of Incorporation divides our Board into three classes, each consisting as nearly as possible of one-third of the members of the whole Board. There are currently three directors in Class I and four directors in each of Classes II and III.Class. The members of each class serve for three years following their election, with one class being elected each year.

Four Three Class II directors are to be elected at the 20212024 Annual Meeting. As previously announced, John R. Huff, currently serving as a Class II director, gave notice that he would not be standing for reelection and will, therefore, cease to be a member of the Board concurrently with the election of Class II directors at the 2021 Annual Meeting. If elected by our shareholders at the 2021 Annual Meeting, it is anticipated that Dr. Kavitha Velusamy, currently serving as a Class III director, would continue as a Class II director and the number of directors in Class III would be reduced accordingly, so that, following the election, the classes of directors would be as nearly equal in number as possible, as required by our Amended and Restated Bylaws.

In accordance with our Amended and Restated Bylaws (the “Bylaws”), directors are elected by a plurality of the votes cast. However, our Corporate Governance Guidelines provide that, in an uncontested election of directors, any director nominee who does not receive a “for” vote by a majority of shares present in person or by proxy and entitled to vote and actually voting on the matter shall promptly tender his or hertheir resignation to the Nominating, and Corporate Governance and Sustainability Committee of our Board, subject to acceptance by the Board. The Nominating, and Corporate Governance and Sustainability Committee will then make a recommendation to the Board with respect to the director’s resignation and the Board will consider the recommendation and take appropriate action within 120 days from the date of the certification of the election results. AbstentionsWithholding of authority to vote for a director nominee and broker “non-votes” marked on proxy cards will not be counted in the election.election and will have no effect on the election of directors.

Each Class II director will serve until the 20242027 Annual Meeting of Shareholders or until a successor has been duly elected and qualified. The terms of office of the directors in Classes I and III will expire at the Annual Meetings of Shareholders to be held in 20232026 and 2022,2025, respectively.

Our Board unanimously recommends a vote FOR election of the nominees for Class II directors named below.

The persons named in the accompanying proxy intend to vote all proxies received in favor of the election of the nominees named below, except in any case where authority to vote for the directors is withheld. Although we have no reason to believe that the nominees will be unable to serve as directors, if any nominee withdraws or otherwise becomes unavailable to serve, the persons named as proxies will vote for any substitute nominee our Board designates.

INFORMATION ABOUT NOMINEES FOR ELECTION AND CONTINUING DIRECTORS

Set forth below is information (ages are as of May 7, 2021)10, 2024) with respect to the four nominees for election as Class II directors, Ms. Karen H. Beachy, Ms. Deanna L. Goodwin Dr. Kavitha Velusamy and Mr. Steven A. Webster, as well as the continuing directors of Oceaneering.

Board Highlights

Our Board believes that effective oversight and advancement of our long-term strategy comes from the contributions of directors with diverse and complementary qualifications, attributes, skills and expertise (“Qualifications”). The Nominating, Corporate Governance and Sustainability Committee establishes and regularly reviews with the Board the Qualifications that it believes are desirable to be represented on our Board to ensure that they align with Oceaneering’s core values and long-term strategy. The Board Skills and Experience Matrix includes a subset of these Qualifications and is summarized below.

The Board endeavors to retain directors with a deep knowledge of Oceaneering and relevant industries as well as attract directors with fresh perspectives. The Nominating, Corporate Governance and Sustainability Committee and the Board believe that the current composition of the Board reflects a group of highly talented individuals with diverse Qualifications best suited to perform oversight responsibilities for Oceaneering and our shareholders and to promote achievement of our long-term strategy.

In addition to the Qualifications highlighted on the Board Skill and Experience Matrix below:

•All members of our Board have been determined to be financially literate.

•Other than Mr. Larson, all members of our Board have been determined to be independent according to the standards of the New York Stock Exchange. In addition, our standing Board committees are entirely comprised of Board members who are not and were not previously employed by or otherwise affiliated with Oceaneering.

•All members of our Board have held executive and board roles with publicly traded companies where they have had significant responsibility driving and overseeing organic and inorganic growth and expansion, strategic plan development, and driving shareholder value.

•Our Board members’ service ranges from less than one to 13 years, with a median tenure of seven years.

| | | | | | | | | | | | | | |

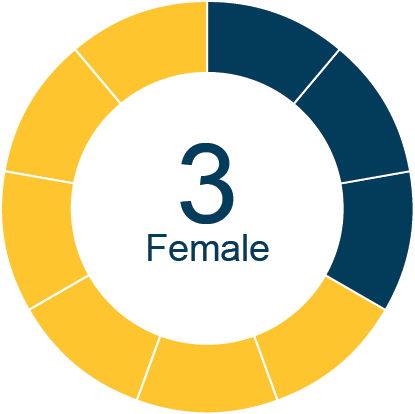

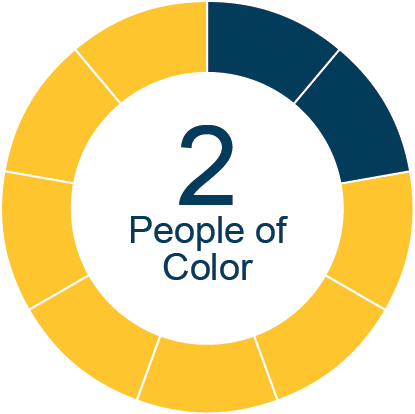

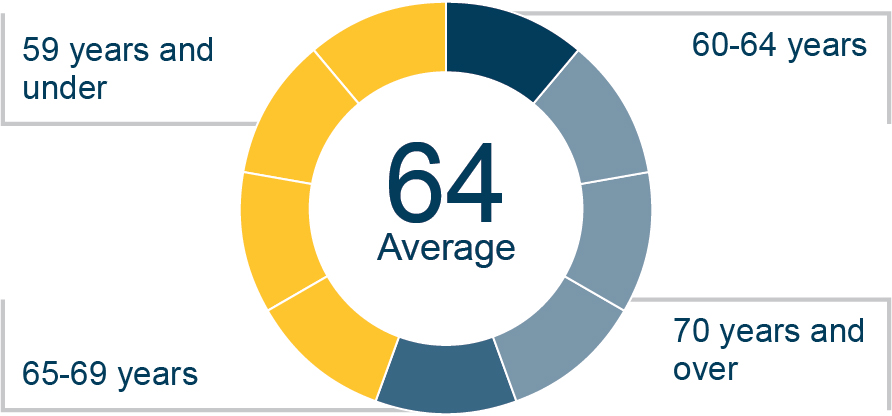

| Gender Diversity | | Racial/Ethnic Diversity | | Mix of Ages |

| | | | |

| | | | |

Board Skills and Experience

In selecting and defining the Qualifications reflected in the Board Skills and Experience Matrix below, the Board considered how such Qualifications align to its oversight capabilities, critical needs and strategic priorities.

The Board recognizes that its members have at least a deep proficiency in all or nearly all of the identified Qualifications. However, based on a contextual review of the particular roles each director plays on the Board, it identified members as having expertise only if such expertise was gained through experience as a senior executive with direct involvement or significant responsibility over time and/or with high profile and complex matters. As a result, the absence of a selection on the Board Skills and Experience Matrix should not be interpreted as a lack of expertise or contribution as it relates to that skill. The Company benefits greatly from having directors with diverse skill sets who contribute in ways that are beyond the items highlighted on the matrix.

Nominees for Election

Class II Director Positions (2021 -– 2024)

| | | | | | | | | | | |

| | Karen H. Beachy Age: 5053 Director since: January 2021 Committee:Committees: Audit; Compensation

|

CAREER HIGHLIGHTS •Think B3 Consulting, LLC, Principal Consultant and Founder (2021 – Present) •The Alliance Risk Group, LLC (2022 – 2024) •Black Hills Corporation (2014 – 2020) •Senior Vice President, Growth and Strategy •Vice President, Supply Chain •Director, Supply Chain •Vectren Corporation (2010 – 2014) •LG&E Energy Corporation and predecessors LG&E and KU Energy LLC (1995 – 2006) |

QUALIFICATIONS The Board has determined that Ms. Beachy is qualified to serve on our Board based on her extensive experience in corporate strategy implementation, corporate and business development and supply chain management during a career spanning over 25 years, her familiarity with public company governance as an executive officer, thorough knowledge of the natural gas and electric utility businesses and demonstrated ability in stakeholder engagement. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •Pangaea Logistics Solutions Ltd., Director (2022 – Present) |

Ms. Beachy served in roles of increasing responsibility with Black Hills Corporation, an investor-owned utility, from July 2014 until her departure in December 2020, most recently as Senior Vice President, Growth and Strategy from August 2019. Previously, she served that company as Vice President, Growth and Strategy from October 2018, Vice President, Supply Chain from September 2016 and Director, Supply Chain from July 2014. Prior to joining Black Hills Corporation, Ms. Beachy served in management roles in natural-gas field operations and strategic sourcing for Vectren Corporation, an investor-owned utility, from May 2010, after two years in management consulting and 13 years with LG&E Energy Corporation and its successors (now known as LG&E and KU Energy LLC).

The Board has determined that Ms. Beachy is qualified to serve on our Board based on her extensive experience in corporate strategy implementation, business development and supply chain management during a career spanning over 25 years, her familiarity with public company governance as an executive officer, thorough knowledge of the natural gas and electric utility businesses, and demonstrated ability in stakeholder engagement.

| | | | | | | | | | | |

| | Deanna L. Goodwin Age: 5659 Director since: February 2018 Committees: Audit; Compensation (Chair) |

CAREER HIGHLIGHTS •Technip (2013 – 2017) •President, North America Region •Chief Operating Officer, Offshore •Senior Vice President, Operations Integration •Veritas DGC, Inc. (1993 – 2008) •President, Western Hemisphere •President, Land •Senior Vice President, Operations •Vice President, US Land Library •Chief Financial Officer and Vice President, Land Division •PricewaterhouseCoopers (predecessor Price Waterhouse) (1987 – 1993) |

QUALIFICATIONS The Board has determined that Ms. Goodwin is qualified to serve on our Board based on her considerable executive experience, particularly with operational and financial management, and service as a director of international public companies. Ms. Goodwin’s significant accounting and auditing background, including over 25 years of experience in the oil and gas products and services industry, and experience as a director of other public companies, allow her to provide valuable contributions to our Board. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •Kosmos Energy Ltd., Director (2018 – Present) •Arcadis NV, Director (2016 – Present) •Chartered Professional Accountants of Canada, Member |

Ms. Goodwin has been a member of the supervisory board of Arcadis NV, a global design, engineering and management consulting company, since April 2016, and a director of Kosmos Energy Ltd. since June 2018. Ms. Goodwin served as President, North America Region, of Technip USA, Inc. from December 2013 until her retirement in January 2017, following completion of the business combination involving Technip S.A. and FMC Technologies, Inc. Previously, Ms. Goodwin held other operational and financial leadership positions with Technip USA, Inc. and its predecessors from 2007 and with Veritas DGC, Inc. from 1993 to 2007. She began her career as an auditor with Price Waterhouse, now PricewaterhouseCoopers, in 1987. Ms. Goodwin is a CPA and a member of the Chartered Professional Accountants of Canada.

The Board has determined that Ms. Goodwin is qualified to serve on our Board based on her considerable experience as an executive officer, particularly with operational and financial experience, as well as her accounting background. Ms. Goodwin’s significant operational and financial background, including over 25 years of experience in the oil and gas products and services industry, allows her to provide valuable contributions to our Board.

| | | | | | | | | | | |

| | Kavitha Velusamy

Age: 50

Director since: January 2021

Committee: Audit

| |

Dr. Velusamy serves as Vice President, Software Engineering of Leia, Inc., a light field display technology company, which she joined in July 2020. Previously, Dr. Velusamy served as Vice President, Engineering of iMerit, Inc., a company that enriches and annotates data that powers algorithms in machine learning, from June 2019 to July 2020, and held technical leadership roles with Bossa Nova Robotics, Inc. from May 2016 to March 2019, NVIDIA Corporation from February 2015 to April 2016, and Amazon.com, Inc., from November 2010 to February 2015. Her prior experience also includes working for Cisco Systems, Inc. from 2001 until 2010 and Motorola India Electronics Limited from 1999 until 2000.

The Board has determined that Dr. Velusamy is qualified to serve on our Board based on her contributions to a variety of transformative technologies and extensive experience in technology development and delivery in the fields of telepresence and robotics, which the Board believes may be leveraged by us to enhance capabilities, improve job safety, reduce environmental impacts and generate efficiency gains for our customers in energy-related and non-energy-related industries.

| | | | | | | | | | | |

| | Steven A. Webster Age: 6972 Director since: March 2015 Committees: Nominating, and Corporate Governance and Sustainability (Chair) |

CAREER HIGHLIGHTS •AEC Partners, L.P., Managing Partner (2018 – present) •Avista Capital Partners, Managing Partner (2005 – 2018) •Global Energy Partners, Ltd. (an affiliate of DLJ Merchant Banking and CSFB), Managing Partner (2000 – 2005) •Carrizo Oil & Gas, Chair and co-founder (1993 – 2019) •R&B Falcon Corporation and its predecessor Falcon Drilling Company, Chair, CEO, and founder (1988 –1999) |

QUALIFICATIONS The Board has determined that Mr. Webster is qualified to serve on our Board based on his extensive experience in, and knowledge of, the energy industry, his business leadership skills from his tenure as chief executive officer and board chair of publicly traded companies, his over 30-year career in private equity and investment activities, and his experience as a director of a variety of other public and private companies. Mr. Webster has over 35 years of experience in the onshore and offshore oil and gas exploration and production and oilfield services industries. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •Callon Petroleum Company and its predecessor Carrizo Oil & Gas, Director (1993 – Present) •Camden Property Trust, Trust Manager (1993 – Present) •ERA Group Inc., Director (2013 – 2020) •Basic Energy Services, Inc., Chair (2000 – 2016) |

Mr. Webster has served as Managing Partner of AEC Partners, L.P. since May 2017 and as Co-Managing Partner of Avista Capital Partners, L.P., since he co-founded that firm in 2005. Prior to that time, Mr. Webster served as chairman of Global Energy Partners, Ltd., an affiliate of CSFB Private Equity, from 2000 to 2005, and as the Chief Executive Officer of R&B Falcon Corporation and its predecessor, Falcon Drilling Company, from its founding in 1988 to 1999. Mr. Webster has been a trust manager of Camden Property Trust since 1993, and a director of Callon Petroleum Company and its predecessor, Carrizo Oil & Gas, Inc., since 1993. Within the past five years, Mr. Webster has served as a director of other publicly traded companies, including Era Group Inc. from 2013 to June 2020, Basic Energy Services, Inc. from 2000 to December 2016 and Hercules Offshore, Inc. from 2005 to November 2015.

The Board has determined that Mr. Webster is qualified to serve on our Board based on his extensive experience in, and knowledge of, the energy industry, his business leadership skills from his tenure as chief executive officer of publicly traded companies, his over 30-year career in private equity and investment activities, and his experience as a director of various other public and private companies. Mr. Webster has over 35 years of experience in the onshore and offshore oil and gas exploration and production and oilfield services industries.

Continuing Directors

Class I Director Positions (2020 - 2023)(2023 – 2026)

| | | | | | | | | | | |

| | William B. Berry Age: 6871 Director since: June 2016 Committee:Committees: Compensation

|

CAREER HIGHLIGHTS •Continental Resources, Inc., CEO (2020 – 2023) •ConocoPhillips and its predecessor, Phillips Petroleum Company (1976 – 2008) •Executive Vice President, Exploration and Production •Senior Vice President of Exploration and Production, Eurasia-Middle East •Vice President of Exploration and Production, Eurasia •Vice President of International Exploration and Production, New Ventures •China Country Manager |

QUALIFICATIONS The Board has determined that Mr. Berry is qualified to serve on our Board based on his extensive experience in, and knowledge of, the energy industry, his business acumen and leadership skills derived in part from his tenure as an executive officer of a multinational, publicly traded customer of ours, over 35 years in domestic and international exploration and production, and experience as a director of various other public companies. Mr. Berry has significant financial and operational expertise and experience. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •Continental Resources, Inc., Director (2014 – 2023) •Frank’s International N.V., Director (2015 – 2020) •Teekay Corporation, Director (2012 – 2015) •Access Midstream Partners, L.P., Director (2013 – 2014) •Willbros Group, Inc., Director (2008 – 2014) •Nexen Inc., Director (2008 – 2013) |

Mr. Berry has been a director of Continental Resources, Inc. since 2014 and became its Chief Executive Officer on January 1, 2020. He previously served as Executive Vice President, Exploration and Production, of ConocoPhillips from 2003 until his retirement in 2008, after more than 30 years with ConocoPhillips and its predecessor, Phillips Petroleum Company, during which he held other executive positions in Africa, Asia, Europe and the Middle East. Within the past five years, Mr. Berry also served on the board of directors of other publicly traded companies, including Frank’s International N.V. from 2015 to 2010 and Teekay Corporation from 2011 to 2015.

The Board has determined that Mr. Berry is qualified to serve on our Board based on his extensive experience in, and knowledge of, the energy industry, his business acumen and leadership skills derived in part from his tenure as an executive officer of a multinational, publicly traded customer of ours, his over 30 years in domestic and international exploration and production, and his experience as a director of various other public companies. Mr. Berry has significant financial and operational expertise and experience.

| | | | | | | | | | | |

| | T. Jay Collins

Age: 74

Director since: March 2002

| |

Mr. Collins has been a director of Pason Systems Inc. since 2012 and Murphy Oil Corporation since 2013. He previously served as Oceaneering’s Chief Executive Officer from 2006 to 2011, President from 1998 to 2011 and Chief Operating Officer from 1998 until 2006. Mr. Collins previously held other executive positions with Oceaneering, after joining Oceaneering as Senior Vice President and Chief Financial Officer in 1993. The Board has elected Mr. Collins to succeed Mr. Huff as Chairman of the Board upon the election of Class II directors at the Annual Meeting.

The Board has determined that Mr. Collins is qualified to serve on our Board based on his substantial prior experience as a member of our Board and his thorough knowledge regarding Oceaneering and its businesses, which he gained through his years of service as a member of our executive management team, as well as through his prior service on our Board. Mr. Collins has extensive knowledge of the oil and gas industry. Including his service on our Board, Mr. Collins has over 40 years of experience with companies engaged in oilfield-related or other energy-related businesses.

| | | | | | | | | | | |

| | Jon Erik Reinhardsen Age: 6467 Director since: October 2016 Committees: Compensation; Nominating, and Corporate Governance and Sustainability |

CAREER HIGHLIGHTS •Petroleum Geo-Services ASA, CEO (2008 – 2017) •Alcoa Inc., President Growth, Primary Products (2005 – 2008) •Aker Kvaerner ASA (1983 – 2005) •Group Executive Vice President of Aker Kværner ASA (operated from Houston) •Deputy CEO of Aker Kvaerner Oil & Gas (operated from Houston) •Executive Vice President in Aker Maritime ASA |

QUALIFICATIONS The Board has determined that Mr. Reinhardsen is qualified to serve on our Board based on his extensive experience in, and knowledge of, the subsea oilfield services industry, his involvement with renewable energy, his international perspective and his experience as a director of various other public companies. Including his service on our Board, Mr. Reinhardsen has significant financial and operational expertise and experience spanning over 35 years in engineering-, construction- and energy-related businesses. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •Equinor ASA, Chair (2017 – Present) •Telenor ASA, Director (2014 – 2023) •Borregaard ASA, Director (2016 – 2018) •Cameron International Corporation, Director (2009 – 2016) |

Mr. Reinhardsen has been a director and chair

The Board has determined that Mr. Reinhardsen is qualified to serve on our Board based on his extensive experience in, and knowledge of, the subsea oilfield services industry, his involvement with renewable energy, his international perspective and his experience as a director of various other public companies. Including his service on our Board, Mr. Reinhardsen has significant financial and operational expertise and experience spanning over 35 years in engineering-, construction- and energy-related businesses.

| | | | | | | | |

| | Reema Poddar Age: 56 Director since: February 2024 Committees: Nominating, Corporate Governance and Sustainability |

CAREER HIGHLIGHTS •Philips, Executive Vice President and General Manager – Diagnostic & Pathway Informatics Business (2022 – 2023) •OptimEyes.AI,Executive Head of Product Development (2020 – 2022) •Teradata Corporation (2017 – 2020) •Executive Vice President & Chief Development Officer •Executive Vice President & Chief Product & Technology Officer •Senior Vice President Product Development •AdFender, Inc., Co-founder (2010), Executive Head of Engineering & Operations (2016 – 2017) •General Electric (2002 – 2016) •Executive Vice President, Global Asset Performance Software Products & Services •Executive Vice President, Global Software & Solutions Head for GE Industry Verticals •Global Head of Technology & Center head of GE Innovation Center |

QUALIFICATIONS The Board has determined that Ms. Poddar is qualified to serve on our Board based on her extensive global experience in product and technology strategy, development and delivery; accelerating digital transformation; and cybersecurity. Ms. Poddar’s 30-year career includes executive and board roles for public, private, and start-up companies where she developed deep expertise in enterprise risk management and oversaw the full product innovation roadmap from concept development to delivery. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •MeridianLink Inc., Director (2021 – Present) •Accion Labs Group Holdings, Inc., Director (2021 – Present) •OptimEyes.AI, Director (2021 – Present) •Corporate Council Board of Advisors to the Dean of UC San Diego Jacobs School of Engineering, Director (2018 – 2020) |

Class III Director Positions (2019 - 2022)(2022 – 2025)

| | | | | | | | | | | |

| | Roderick A. Larson,President and Chief Executive Officer Age: 5457 Director since: May 2017 Committees: N/A |

CAREER HIGHLIGHTS •Oceaneering (2012 – Present) •President and CEO •Chief Operating Officer •Senior Vice President •Baker Hughes Incorporated (2007 – 2012) •President, Latin American Region •Vice President of Operations, Gulf of Mexico Region |

QUALIFICATIONS The Board has determined that Mr. Larson is qualified to serve on our Board based on his in-depth knowledge regarding our business and the energy industry and his leadership skills, derived from his service as a member of our executive management team; ten years of experience as an independent director for a public company; and over 30 years of experience in the oilfield services industry. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •Newpark Resources, Inc., Director (2014 – Present) •American Petroleum Institute, Director (2017 – Present) •National Ocean Industries Association, Director (2018 – Present) •Energy Workforce and Technology Council, Chair (2021) |

Mr. Larson has served as President and Chief Executive Officer of Oceaneering since May 2017 and as President since 2015. Mr. Larson previously served as Senior Vice President and Chief Operating Officer from 2012 to 2015. Prior to joining Oceaneering in 2012, Mr. Larson was employed by Baker Hughes Incorporated for more than 20 years, where he held various leadership and technical positions, including most recently as President, Latin America Region, from 2011 to 2012 and Vice President of Operations, Gulf of Mexico Region, from 2009 to 2011. He has been a director of Newpark Resources, Inc. since 2014. Mr. Larson serves on the boards of the American Petroleum Institute and the National Ocean Industries Association and is the 2021 Chair of the Energy Workforce and Technology Council.

The Board has determined that Mr. Larson is qualified to serve on our Board based on his in-depth knowledge regarding our business, derived from his service as a member of our executive management team, service as a public company director for over six years and over 25 years of experience in the oilfield services industry.

| | | | | | | | | | | |

| | M. Kevin McEvoy Age: 7073 Director since: May 2011 Committees: N/A |

CAREER HIGHLIGHTS •Oceaneering (1979 – 2017) •CEO •President •Chief Operating Officer •Executive Vice President •Senior Vice President, Western Region •U.S. Navy, Diving and Salvage Officer (1972 – 1976) |

QUALIFICATIONS The Board has determined that Mr. McEvoy is qualified to serve on our Board based on his thorough knowledge of Oceaneering and its businesses, which he gained through his years of service in each of our business segments (including three international assignments) and as a member of our executive management team and Board of Directors, as well as through his service as an independent director of a publicly traded company in the construction industry. A U.S. Navy veteran, Mr. McEvoy has over 45 years of experience in offshore, diving and other subsea and marine-related activities, primarily in oilfield-related areas, with significant international exposure. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •EMCOR Group, Inc. •Independent Lead Director (2018 – Present) •Director (2016 – Present) •National Ocean Industries Association, Past Chairman |

Mr. McEvoy has been a director of EMCOR Group, Inc. since June 2016. Previously, he served as Chief Executive Officer of Oceaneering from 2011 to May 2017 and President from 2011 to 2015. Mr. McEvoy’s service with Oceaneering began in 1979 with Solus Ocean Systems, Inc., which Oceaneering acquired in 1984, and included senior management positions in each of our operating groups prior to being appointed Senior Vice President, Western Region, in 2000, Executive Vice President in 2006 and Chief Operating Officer in 2010.

The Board has determined that Mr. McEvoy is qualified to serve on our Board based on his thorough knowledge of Oceaneering and its businesses, which he gained through his years of service in each of our five business segments and as a member of our executive management team, as well as through his service on our Board and as an outside director of a publicly traded company in the construction industry. Mr. McEvoy has over 40 years of experience in offshore, diving and other subsea and marine-related activities, primarily in oilfield-related areas, with significant international exposure.

| | | | | | | | | | | |

| | Paul B. Murphy, Jr. Age: 6164 Director since: August 2012 Committees: Audit (Chair); Nominating, and Corporate Governance and Sustainability |

CAREER HIGHLIGHTS •Cadence Bank and its predecessors Cadence Bancorporation and Cadence Bank, N.A., CEO (2009 – 2023) •Amegy Bank of Texas, CEO (1990 – 2009) |

QUALIFICATIONS The Board has determined that Mr. Murphy is qualified to serve on our Board based on his considerable experience as an executive officer and director of both privately owned and publicly traded companies, particularly financial institutions. Mr. Murphy’s financial background, including over 40 years of business and entrepreneurial experience in the financial services industry, allows him to provide valuable contributions to our Board. Including his service on our Board, Mr. Murphy has over 25 years of experience as a director of publicly traded companies. |

OTHER BOARD DIRECTORSHIPS AND ORGANIZATIONS •Natural Resource Partners L.P.,Director (2018 – Present) •Cadence Bank, Director (2021 – 2023) •Amegy Bank of Texas, Director (1994 – 2009) •Hines REIT, Director (2008 – 2017) •Houston Branch of the Federal Bank Reserve of Dallas, Director (2009 – 2016) |

Mr. Murphy has been Chief Executive Officer and chairman of the board of directors of Cadence Bancorporation and its predecessors since 2009. From 1990 to 2009, Mr. Murphy was employed by Amegy Bank of Texas, where he served in senior leadership roles, including as Chief Executive Officer from 2000 to 2009 and as a director of that bank from 1994 to 2009. Within the past five years, Mr. Murphy has also served as a director of the Federal Reserve Bank of Dallas – Houston Branch from 2009 to 2015 and as a director of Hines Real Estate Investment Trust, Inc. from 2008 to November 2018. Mr. Murphy has been a director of the general partner of Natural Resource Partners L.P. since March 2018.

The Board has determined that Mr. Murphy is qualified to serve on our Board based on his considerable experience as an executive officer and director of both privately owned and publicly traded companies, particularly financial institutions. Mr. Murphy’s financial background, including over 35 years of business and entrepreneurial experience in the financial services industry, allows him to provide valuable contributions to our Board. Including his service on our Board, Mr. Murphy has over 20 years of experience as a director of publicly owned companies.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth the number of shares of Common Stock beneficially owned as of March 17, 202120, 2024, by each director and nominee for director, each of the executive officers named in the Summary Compensation Table in this Proxy Statement, and all directors and executive officers as a group. Except as otherwise indicated, each individual named has sole voting and dispositive power with respect to the shares shown. | | | | | | | | | | | | | | | | | | | | |

| Name | | Number of

Shares (1) | | Number of

Shares Underlying

Restricted Stock

Units (2) | | Total (3) |

| Karen H. Beachy | | 22,786 | | | — | | | 22,786 | |

| William B. Berry | | 78,202 | | | — | | | 78,202 | |

| Earl F. Childress | | 36,054 | | | 36,373 | | | 72,427 | |

| Alan R. Curtis | | 89,129 | | | 100,403 | | | 189,532 | |

| Deanna L. Goodwin | | 19,899 | | | — | | | 19,899 | |

| Roderick A. Larson | | 339,140 | | | 302,046 | | | 641,186 | |

| Martin J. McDonald | | 74,301 | | | 41,589 | | | 115,890 | |

| M. Kevin McEvoy | | 138,530 | | | — | | | 138,530 | |

| Paul B. Murphy, Jr. | | 65,910 | | | — | | | 65,910 | |

| Reema Poddar | | — | | | — | | | — | |

| Jon Erik Reinhardsen | | 78,202 | | | — | | | 78,202 | |

| Jennifer F. Simons | | — | | | 83,358 | | | 83,358 | |

| Steven A. Webster | | 142,933 | | | — | | | 142,933 | |

| All directors and executive officers as a group (20 persons) | | 1,272,458 | | | 716,934 | | | 1,989,392 | |

| | | | | | | | | | | | | | | | | | | | |

| Name | | Number of

Shares (1) | | Number of

Shares Underlying

Restricted Stock

Units (2) | | Total (3) |

| Karen H. Beachy | | 17,387 | | | — | | | 17,387 | |

| William B. Berry | | 58,303 | | | — | | | 58,303 | |

| T. Jay Collins | | 49,103 | | | — | | | 49,103 | |

| Alan R. Curtis | | 52,545 | | | 110,646 | | | 163,191 | |

| Charles W. Davison, Jr. | | 15,263 | | | 202,742 | | | 218,005 | |

| Deanna L. Goodwin | | 48,303 | | | — | | | 48,303 | |

| John R. Huff | | 170,039 | | | — | | | 170,039 | |

| Roderick A. Larson | | 124,461 | | | 343,328 | | | 467,789 | |

| David K. Lawrence | | 48,611 | | | 71,770 | | | 120,381 | |

| M. Kevin McEvoy | | 159,909 | | | — | | | 159,909 | |

| Paul B. Murphy, Jr. | | 46,011 | | | — | | | 46,011 | |

| Jon Erik Reinhardsen | | 58,303 | | | — | | | 58,303 | |

| Eric A. Silva | | 37,589 | | | 54,120 | | | 91,709 | |

| Kavitha Velusamy | | 17,387 | | | — | | | 17,387 | |

| Steven A. Webster | | 62,303 | | | — | | | 62,303 | |

| All directors and executive officers as a group (23 persons) | | 1,103,475 | | | 1,014,055 | | | 2,117,530 | |

(1)There are no outstanding stock options held by any of our directors or executive officers. Includes the following shares granted in 2021 pursuant to restricted stock award agreements, as to which the recipient has sole voting power and no current dispositive power: Ms. Beachy – 17,387; Mr. Berry – 17,387; Mr. Collins – 17,387; Ms. Goodwin – 17,387; Mr. Huff – 25,817; Mr. McEvoy – 17,387; Mr. Murphy – 17,387; Mr. Reinhardsen – 17,387; Dr. Velusamy – 17,387; Mr. Webster – 17,387; and all directors and executive officers as a group – 182,300. Also includes the following share equivalents, which are fully vested but are held in trust pursuant to the Oceaneering Retirement Investment Plan (the “401(k) Plan”), as to which the indicated persons have the right to direct the plan trustee on how to vote: Mr. Curtis – 13,148; Mr. Lawrence – 4,470;14,318; and all directors and executive officers as a group – 52,567.69,018. At withdrawal, the share equivalents in the 401(k) Plan are to be settled in shares of Common Stock. Also includes the following shares as to which the indicated person has shared voting and dispositive power: Mr. Larson – 310,268. The beneficial ownership of (a) each director and executive officer represents 0.2%0.3% or less of the outstanding Common Stock and (b) all directors and executive officers as a group represents 1.1%1.3% of the outstanding Common Stock. There are no outstanding stock options held by any of our directors or executive officers.

(2)Includes shares of Common Stock that are represented by restricted stock units of Oceaneering that are credited to the accounts of certain individuals and are subject to vesting. The individuals have no voting or investment power over these restricted stock units.

(3)The indicated shares of Common Stock and Common Stock underlying restricted stock units of (a) each director and executive officer represent 0.5%0.6% or less of the outstanding Common Stock and (b) all directors and executive officers as a group represent 2.1%2.0% of the outstanding Common Stock.

Listed below are the only persons who, to our knowledge, may be deemed to be beneficial owners as of March 17, 202120, 2024, of more than 5% of the outstanding shares of Common Stock. This information is based on beneficial ownership reports filed with the U.S. Securities and Exchange Commission (the “SEC”). | | | | | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | | Percent

of Class (1) |

BlackRock, Inc.

50 Hudson Yards

New York, NY 10001 | | 16,015,288 | (2) | | 15.8 | % |

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355 | | 12,461,454 | (3) | | 12.3 | % |

EARNEST Partners, LLC

1180 Peachtree Street NE, Suite 2300

Atlanta, GA 30309 | | 5,166,012 | (4) | | 5.1 | % |

State Street Corporation

State Street Financial Center

1 Congress Street, Suite 1

Boston, MA 02114-2016 | | 5,042,866 | (5) | | 5.0 | % |

| | | | | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | | Percent

of Class (1) |

BlackRock, Inc.

55 East 52nd Street

New York, NY 10055 | | 16,991,903 | (2) | | 17.1 | % |

The Vanguard Group

100 Vanguard Blvd.

Malvern, PA 19355 | | 10,882,110 | (3) | | 10.9 | % |

FMR LLC

245 Summer Street

Boston, MA 02210 | | 10,536,593 | (4) | | 10.6 | % |

(1)All percentages are based on the total number of issued and outstanding shares of Common Stock as of March 17, 2021.20, 2024.

(2)The amount beneficially owned of 16,991,90316,015,288 shares of Common Stock, as shown, is as reported by BlackRock, Inc. in a Schedule 13G13G/A filed with the SEC on January 25, 2021.22, 2024. The Schedule 13G13G/A reports that BlackRock, Inc. has sole voting power with respect to 16,613,87515,777,722 shares and sole dispositive power with respect to 16,991,90316,015,288 shares. The Schedule 13G13G/A further reports that: (a) BlackRock Fund Advisors, a subsidiary of BlackRock, Inc., is the beneficial owner of 5% or greater of the Common Stock outstanding; and (b) iShares Core S&P Small-Cap ETF has the power to direct the receipt of dividends from, or the proceeds from the sale of the Common Stock of, 5% or more of the Common Stock outstanding.

(3)The amount beneficially owned of 10,882,11012,461,454 shares of Common Stock, as shown, is as reported by The Vanguard Group in a Schedule 13G/A filed with the SEC on February 10, 2021.13, 2024. The Schedule 13G/A reports that The Vanguard Group has sole voting power with respect to 0zero shares, sole dispositive power with respect to 10,702,20512,177,878 shares, shared voting power with respect to 98,147189,022 shares and shared dispositive power with respect to 179,905283,576 shares. The Schedule 13G/A further reports that certain subsidiaries of The Vanguard Group own shares of Common Stock but does not identify any such subsidiary as beneficially owning 5% or greater of the Common Stock outstanding.

(4)The amount beneficially owned of 10,536,5935,166,012 shares of Common Stock, as shown, is as reported by FMREARNEST Partners, LLC in a Schedule 13G/A filed with the SEC on February 8, 2021.March 11, 2024. The Schedule 13G/A reports that FMREARNEST Partners, LLC has sole voting power with respect to 1,096,1843,005,598 shares and sole dispositive power with respect to all 10,536,5935,166,012 shares.

(5)The amount beneficially owned of 5,042,866 shares of Common Stock, as shown, is as reported by State Street Corporation in a Schedule 13G/A filed with the SEC on January 24, 2024. The Schedule 13G/A identifies FMR LLC as a parent holding company and identifies the relevant subsidiaries of FMR LLC collectively and beneficially owning the shares being reported in the Schedule 13G/A as: FIAM LLC and Fidelity Management & Research Company LLC (“FMR Co. LLC”). The Schedule 13G/A further reports: (a) FMR Co. LLC is the beneficial owner of 5% or greater of the Common Stock outstanding; (b) Abigail P. Johnson is a director, the chairman and the chief executive officer of FMR LLC; (c) members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of thereports that State Street Corporation has sole voting equity of FMR LLC; (d) the Johnson family group and other equity owners of FMR LLC have entered into a voting agreement; (e) through their ownership of voting equity and the execution of the voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, as amended (the “Investment Company Act”), to form a controlling grouppower with respect to FMR LLC; (f) neither FMR LLC nor Abigail P. Johnson has thezero shares, sole dispositive power with respect to vote or direct thezero shares, shared voting of thepower with respect to 4,701,870 shares owned directly by the various investment companies registered under the Investment Company Act (the “Fidelity Funds”) advised by Fidelity Management & Research Company, a wholly owned subsidiary of FMR LLC, whichand shared dispositive power resides with the Fidelity Funds’ boards of trustees; and (g) FMR Co. LLC carries out the voting of the shares under written guidelines established by the Fidelity Funds’ boards of trustees. The Schedule 13G/A disclaims reporting on shares, if any, beneficially owned by certain subsidiaries, affiliates or other companies whose beneficial ownership of shares is disaggregated from that of the FMR reporting entities in accordance with SEC Release No. 34-39538 (January 12, 1998).

respect to 5,042,866 shares.

CORPORATE GOVERNANCE

During 2020,2023, our Board held five meetings of the full Board and 1415 meetings of committees of the Board. Each of our directors attended at least 75% of the aggregate number of meetings of the Board and meetings of committees of the Board on which he or shethey served (during the period of service). All directors are invited to attend all meetings of the committees of the Board. In 2023, no committee meetings were scheduled or held concurrently; as a result, most directors attended most or all of the committee meetings regardless of whether they served on the committees. In addition, we have a policy that directors are encouraged to attend the Annual Meeting. Last year, all of our directors attended our Annual Meeting. In 2020,2023, the nonemployee directors met in regularly scheduled executive sessions without management present, and similar sessions are scheduled for 2021. The chairmen2024. Under our Corporate Governance Guidelines, the chairs of the Audit Committee, Compensation CommitteeBoard and Nominating and Corporate Governance CommitteeCommittees chair these executive sessions on a rotating basis under our Corporate Governance Guidelines. sessions.

Interested parties may communicate directly with the nonemployee directors by sending a letter to the “Board of Directors (Independent Members),” c/o Corporate Secretary, Oceaneering International, Inc., 11911 FM 529,5875 N. Sam Houston Pkwy. W., Suite 400, Houston, Texas 77041-3000.77086.

Under rules adopted by the New York Stock Exchange (the “NYSE”), our Board must have a majority of independent directors. The director independence standards of the NYSE require a board determination that ouran independent director hashave no material relationship with us and has no specific relationships that preclude independence. Our Board considers relevant facts and circumstances in assessing whether a director is independent. Our Board has determined that, with the exception of Messrs.Mr. Larson, and McEvoy, all of our directors currently meet the NYSE independence requirements.

We have three standing committees of our Board, composed as follows:

| | | | | | | | | | | | | | | | | | | | |

| Director | | Audit

Committee | | Compensation

Committee | | | | | | | | | | | | | | | | | | Nominating, Corporate Governance and Sustainability Committee |

Director | | Audit

Committee | | Compensation

Committee | | Nominating and Corporate Governance Committee |

| Karen H. Beachy | | Member | | Member | | | Member | |

| William B. Berry | | | | Member | | | Member | | |

| Deanna L. Goodwin | | Member | | MemberChair | | | Chair | |

| Paul B. Murphy, Jr. | | Chair | | Chair | | Member |

| Reema Poddar | | | | | | Member |

| Jon Erik Reinhardsen | | | | Member | | Member |

Jon Erik Reinhardsen | | Member | | Member | | Member |

Kavitha Velusamy | | Member | | | | |

| Steven A. Webster | | | | | | Chair |

Our Board has determined that each member of these committees is independent in accordance with the requirements of the NYSE. Our Board has also determined that each member of the Audit Committee meets the independence requirements that the SEC has established for service on an audit committee.

COMMITTEES OF THE BOARD

Audit Committee

The Audit Committee, which is comprised of directors Murphy (Chair), Beachy and Goodwin, Reinhardsen (who succeeded Mr. Collins as a member of the committee in May 2020) and Velusamy (since her appointment in January 2021), held sixseven meetings during 2020.2023.

Our Board has determined that Ms. Goodwin and Messrs.Mr. Murphy and Reinhardsen are audit committee financial experts and that all current members of the Audit Committee are financially literate, as defined in the applicable rules of the SEC and the NYSE. For information relating to the background of each member of the Audit Committee, see the biographical information under “Information about Nominees for Election and Continuing Directors.”

The Audit Committee is appointed by our Board, on the recommendation of the Nominating, and Corporate Governance and Sustainability Committee, to assist the Board in its oversight of:

•the integrity of our financial statements;

•our compliance with applicable legal and regulatory requirements;

•the independence, qualifications and performance of our independent auditors;

•the performance of our internal audit functions; and

•the adequacy of our internal control over financial reporting.

Our management is responsible for our internal controls and preparation of our consolidated financial statements. Our independent auditors are responsible for performing an independent audit of the consolidated financial statements and internal controls over financial reporting and issuing reports thereon. The Audit Committee is responsible for overseeing the conduct of these activities and appointing our independent auditors. The Audit Committee operates under a written charter adopted by our Board. As stated above and in the Audit Committee Charter,charter, the Audit Committee’s responsibility is one of oversight. The Audit Committee is not providing any expert or special assurance as to Oceaneering’s financial statements or any professional certification as to the independent auditors’ work.

The Audit Committee annually reviews the performance and independence of the independent auditors in deciding whether to retain the current independent auditors or engage a different independent registered public accounting firm for the ensuing year. In the course of these reviews, the Audit Committee considers, among other things, the independent auditors’: general qualifications; historical quality of service provided to us; sufficiency of resources; quality of communication and interaction; and independence, objectivity and professional skepticism. The Audit Committee also considers whether, in order to assure continuing auditor independence, there should be regular rotation of the independent registered public accounting firm acting as our independent auditor, which includes consideration of the advisability and potential impact of selecting a different independent registered public accounting firm.

In discharging its duties, the Audit Committee also reviews and approves the scope of the annual audit, non-audit services to be performed by the independent auditors, and the independent auditors’ audit and non-audit fees; reviews and discusses with management (including the senior internal auditor) the independent auditors’ annual audit of our internal control over financial reporting; recommends to our Board that the audited financial statements be included in the Annual Report on Form 10-K for filing with the SEC; meets independently with our senior compliance and internal audit personnel, independent auditors and management; reviews, among other things, the general scope of our accounting, financial reporting, annual audit and our internal audit programs and matters relating to internal control systems, information technology and cybersecurity, legal and regulatory matters and taxes, as well as the use of any “non-GAAP financial measures” (including environmental, social, and

governance measures and metrics) and the results of the annual audit and interim financial statements, auditor independence issues and the adequacy of the Audit Committee charter; and reviews with management and the independent auditors any correspondence with regulators or governmental agencies and any published reports that raise material issues regarding our financial statements or accounting policies.

A copy of the Audit Committee charter is available under the Governance tab in the Investor RelationsInvestors section of our website (www.oceaneering.com). Any shareholder may obtain a written copy of the charter from us upon request. The report of the Audit Committee is included in this Proxy Statement under the heading “Report of the Audit Committee.”

Compensation Committee

The Compensation Committee, comprised of directors Goodwin (Chair), Beachy, (since her appointment in January 2021), Berry and Reinhardsen, held four meetings during 2020. Effective in March 2020, Ms. Goodwin replaced Mr. Berry as Chair of the Compensation Committee.2023.

The Compensation Committee is appointed by our Board to:

•assist the Board in discharging its responsibilities relating to:to (1) compensation of our executive officers and nonemployee directors;directors and (2) employee benefit plans and practices; and

•produce or assist management with the preparation of any reports that may be required from time to time by the rules of the NYSE or the SEC to be included in our proxy statements for our annual meetings of shareholders or annual reports on Form 10-K.

Specific duties and responsibilities of the Compensation Committee include:

•overseeing our executive and key employee compensation plans and benefit programs;

•reviewing and approving objectives relevant to the

compensation of executives and key employees, including administrationemployees;

•administering our short-term and long-term incentive plans,plans;

•administering our supplemental executive retirement plan andplan;

•administering our severance, termination and change-of-control arrangements;

•approving employment agreements for key executives;

•reviewing and making recommendations to the Board regarding the directors’ and officers’ indemnification and insurance matters;

•evaluating the performance of executives and key employees, including our Chief Executive Officer;

•recommending to the Board the compensation for the Board and committees of the Board;

•administering the Company’s clawback policy; and

•annually evaluating its own performance and its charter.

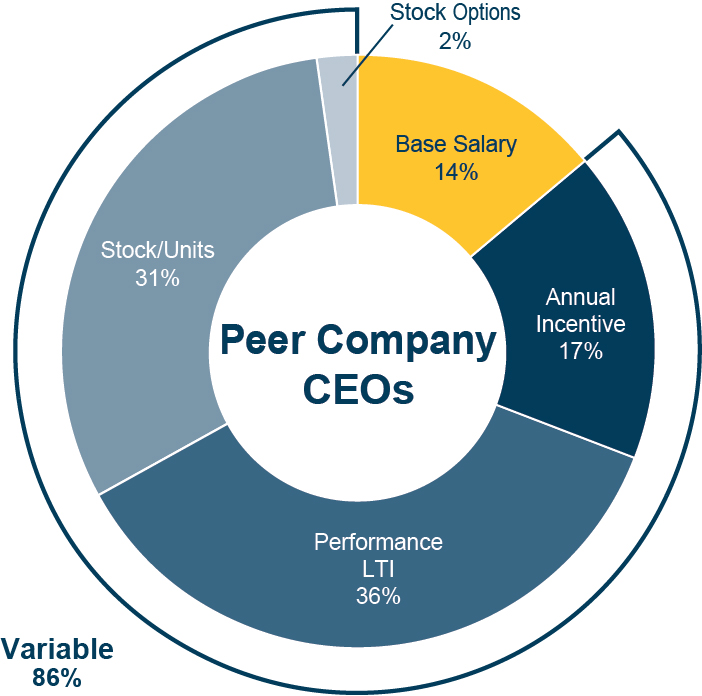

On an annual basis, the Compensation Committee engages a recognized executive compensation consulting firm (the “Compensation Consultant”) to assist the Compensation Committee in its administration of compensation for our directors and executive officers. The Compensation Consultant provides to the Compensation Committee a market analysis including total direct compensation (salary, annual incentive bonus and long-term incentive compensation), retirement benefits and perquisites for each of our executive officers and compensation for nonemployee directors among peer group companies and other survey data (see “Compensation Discussion and Analysis – The Role of the Compensation Consultant” in this Proxy Statement). The Compensation Consultant engaged in 20202023 was Meridian Compensation Partners, LLC (“Meridian”), which has served in this capacity since 2015.

The Compensation Committee approves the forms and amounts of annual and long-term incentive program compensation for our executive officers and other key employees, and recommends to the Board the forms and amounts of compensation for nonemployee directors.

The Compensation Committee operates under a written charter adopted by our Board. A copy of the Compensation Committee charter is available under the Governance tab in the Investor RelationsInvestors section of our website (www.oceaneering.com). Any shareholder may obtain a written copy of the charter from us upon request. The report of the Compensation Committee is included in this Proxy Statement under the heading “Report of the Compensation Committee.”

Nominating, and Corporate Governance and Sustainability Committee

The Nominating, and Corporate Governance and Sustainability Committee (the “Governance & Sustainability Committee”), comprised of directors Webster (Chair), Murphy, and Reinhardsen, held four meetings during 2020.2023. Ms. Poddar was appointed to the Governance and Sustainability Committee in February 2024.

The Nominating and Corporate Governance & Sustainability Committee is appointed by our Board to, among other things:

•consider and recommend to the Board the Qualifications that should be represented on the Board for appropriate oversight and advancement of Oceaneering’s long-term strategy;

•identify individuals qualified to become directors of Oceaneering;

•recommend to our Board candidates to fill vacancies on our Board or to stand for election to the Board by our shareholders;

•recommend to our Board a director to serve as ChairmanChair of the Board;

•recommend to our Board committee assignments for directors;

•periodically assess the performance of our Board and its committees;

•periodically review with our Board succession planning with respect to our Chief Executive Officer and other executive officers;

•monitor and advise the Board regarding environmental, corporate social responsibility, sustainability and governance (collectively, “ESG”) matters and have oversight responsibility for Oceaneering’s public reporting on ESG matters;

•monitor emerging issues potentially affecting the reputation of Oceaneering and the industries in which Oceaneering has significant operations;

•monitor and advise the Board regarding public policy issues, including Oceaneering’s political contributions policies and practices and lobbying priorities and activities;

•evaluate related-person transactions in accordance with our policy regarding such transactions; and

•periodically review and assess the adequacy of our corporate governance policies and procedures.

The Nominating and Corporate Governance & Sustainability Committee operates under a written charter adopted by our Board. A copy of this charter and a copy of our Corporate Governance Guidelines are available under the Governance tab in the Investor RelationsInvestors section of our website (www.oceaneering.com). Any shareholder may obtain a written copy of each of these documents from us upon request.

The Nominating and Corporate Governance & Sustainability Committee solicits ideas for potential Board candidates from a number of sources, including members of our Board and our executive officers. The Committee also has authority to selectrelies on and compensate acompensates third-party search firmfirms to help identify qualified and diverse potential Board candidates if it deems it advisable to do so.

who might not be in the networks of members of our Board and our executive officers.

Shareholder Nominations for Board Candidates

The Nominating and Corporate Governance Committee will also consider nominees recommended by shareholders in accordance with our Bylaws. In assessing the qualificationsQualifications of all prospective nominees to the Board, the Nominating and Corporate Governance & Sustainability Committee will consider, in addition to criteria set forth in our Bylaws, each nominee’s personal and professional integrity, experience, skills, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to acting in the best interests of Oceaneering and its shareholders. Consideration also will be given to the Board’s diversity and having an appropriate mix of backgrounds and skills. In that regard, our Corporate Governance Guidelines provide that any search for potential director candidates should consider diversity as to gender, ethnic background, and personal and professional experiences and thatexperiences; any initial list of new director candidates developed by the Nominating and Corporate Governance & Sustainability Committee, or by a third-party consultant engaged by or on behalf of the Nominating and Corporate Governance Committee,committee, to fill any vacancy in Board membership should include one or more qualified women and minority candidates. It is the sense of the Governance & Sustainability of the Committee that, consistent with shareholder feedback, the Board should reflect at least 30% gender, ethnic, and/or racial diversity.

Shareholder Nominations for Board Candidates

The Governance & Sustainability Committee will also consider nominees recommended by shareholders in accordance with our Bylaws. A shareholder who wishes to recommend a nominee for director should comply with the procedures specified in our Bylaws, as well as applicable securities laws and regulations of the NYSE. The Nominating and Corporate Governance & Sustainability Committee will consider all candidates identified through the processes described above, whether identified by the Nominating and Corporate Governance Committeecommittee or by a shareholder, and will evaluate each of them on the same basis.

As to each person a shareholder proposes to nominate for election as a director, our Bylaws provide that the nomination notice must:

•include the name, age, business address, residence address (if known) and principal occupation or employment of that person, the number of shares of Common Stock beneficially owned or owned of record by that person and any other information relating to that person that is required to be disclosed under Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the related SEC rules and regulations; and

•be accompanied by the written consent of the person to be named in the proxy statement as a nominee and to serve as a director if elected.

The nomination notice must also include, as to that shareholder and any of that shareholder’s “associates” (defined to include (1) any person acting in concert with that shareholder, (2) any person who beneficially owns shares of Common Stock owned of record or beneficially by that shareholder and (3) any person

controlling, controlled by or under common control with, directly or indirectly, that shareholder or any person described in the foregoing clause (1) or (2)) on whose behalf the nomination or nominations are being made:

•the name and address of that shareholder, as they appear on our stock records and the name and address of that associate;

•the number of shares of Common Stock which that shareholder and that associate own beneficially or of record;

•a description of any agreement, arrangement or understanding relating to any hedging or other transaction or series of transactions (including any derivative or short position, profit interest, option, hedging transaction or borrowing or lending of shares) that has been entered into or made by that shareholder or that associate, the effect or intent of which is to mitigate loss, manage risk or benefit from share price changes or to increase or decrease the voting power of that shareholder or that associate, in any case with respect to any share of Common Stock;

•a description of all arrangements and understandings between that shareholder or that associate and each proposed nominee of that shareholder and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by that shareholder;

•a representation by that shareholder that he or she intendsthey intend to appear in person or by proxy at that meeting to nominate the person(s) named in that nomination notice;